I started as a Timothy Sykes student. Rapidly after a few months of reviewing all his content under the millionaire challenge, I found myself with a handful of different strategies to potentially apply to trade the market yet not real guidance in which direction to go.

At first, I was making profits following three strategies. However, as anxiety to speed up the process and start making more money I started diversifying my strategies to be able to place more trades thinking that, if I can apply more strategies/setups I can trade more, therefore, I can gain more profits. Well, it didn’t take more than a few weeks for me to completely lose control and not being sure what was I doing.

As the week went by, I started to trade fewer setups, still, I even though I was trading at least one or two trades a day, I did not know what I was doing right or wrong. I know I was onto something but I was just not sure what to do with all the information I had. This is when I decided to stop trading and look for a system that can help me understand what is my edge based on my trading pattern. The system was simple, I just needed a trading journal to start journaling my trades and then try to understand what action to take the very next day based on the feedback of my trading journal.

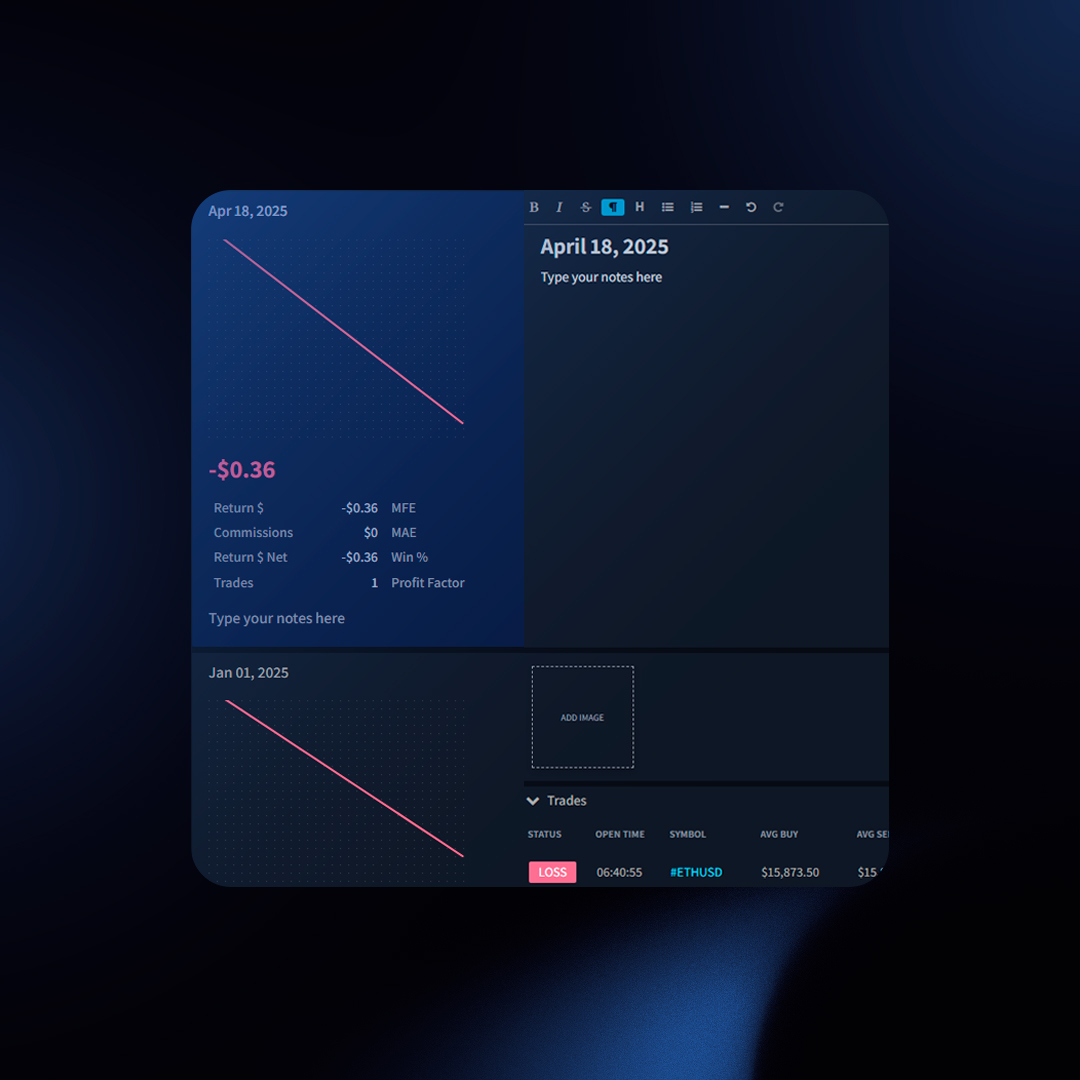

Looking online I tried every single trading journal available and I didn’t find any of them to provide me quick feedback about my trading edge and to be easy to manage on a day to day. This is why I decided to create my own trading journal TraderSync. A platform that will allow me to apply the setups/strategies and all the knowledge I learned with Timothy Sykes and other courses into my trading journal so I can concentrate into trading while the platform will quickly provide me with feedback and help me shape my trading into the right direction.

It only took about a solid month of trading and journaling into TraderSync to start seeing drastic results. Information is power, and those that can count on it, can make a great positive change. TraderSync allows you to keep control of your Timothy Sykes strategies while helping you understand what exactly is happening behind your trades.

Sign up for a free trial here.

In comparison with offline trading journals like the ones being kept on an excel sheet, the online trading journal makes more sense in this century. Just ask yourslef, why keep an offline trading journal where your data can be lost if your computer gets hack or just break. Don’t you want to access your trading journal on the go, whether you are at home, work, in a library or in the car? – Being able to pull your phone to quickly check your online trading journal and get quick insight about your trading patterns is an invaluable asset you can add to your trading arsenal.

There is a few decent online trading journal on the market. However, not all of them will allow you to get as much insight as you will need as you develop your trading expertise. Our online trading journal TraderSync, can ensure you will always get helpful insight and almost non-ending possible correlation in your data that can help you identify your trading edge.

Our platform does not limit you to journal your trades from a single computer, device or place. You can be anywhere as long as you have a device to access the web you should be able to enter into your online trading journal and to keep track of your performance.

We all want to make money out of the market and we want to make it not in a year, not in a month but today. Because of our rush and lack of understanding the odds we find ourself investing in the market without a real plan behind our ideas. We know we need a plan but we tend to think we can make money first and make the plan after. Our trading ego and lack of motivation to dissect our trading weaknesses can make it tough with keeping a trading journal. Well, it is not secret, this technique does not work for most of us.

Without a trading plan, we just fall into the 96% of the traders that lose money in the market. Let’s be real, we can not control the outcome of the market, the only thing we can control is how much we are willing to lose in a trade. This is why our plan should be focus on what we can control.

The potential solution to get into the small 4% that actually make money is to have a better understanding of our trading edge. This can only be gained from a trade journal. The tool that will run through your past performance and give you insight into what is it that you are doing wrong.

Yes, we all know we should be keeping a trade journal, every course you take online, every book related to trading the market will tell you that. The problem is how you come up with the willpower to actually developed a consistent habit of journaling your trades.

Start Simple: A trade journal can get very complex in terms of the different data points you could be collecting to get you more insight. We recommend you start by tracking only the essentials such but not limited to entry date-time, entry price, exit date-time, exit-price, position size and the reasoning why you took the trade. Just by starting with this six simple data points could give you enough insight for you to start gaining benefits out of your work.

Make a Rule: Do not just try to journal at different points of the day, instead start by journaling right after you took the trade. Immediately you should write down, why you took the trade and the details. Making yourself to write down this information after each execution will help you create a consistent habit.

Understand it is a long-term investment: To gather helpful feedback from your trading journal you must log in at least 100 trades if you are a day trader. You can not expect to gain benefits right out of the start. The benefits come with the long-term investment into placing your data in one place so you or a system can then help you determine your trading edge.

Want to begin keeping a trading journal? Then click here to signup for a free 7-day trial of TraderSync!

Any serious options trader must have an options trading journal to track their trades. Trading journals allow you to gather data about your trades which could then be mined to provide you with great insight that you will not be able to have otherwise.

At very minimum, you should be tracking the following data points:

Tracking this eight data points will get you enough insight into your trades for you to start understanding your performance. Still, we recommend you go beyond this eight data points and track the following:

Tracking these points together with the basic data points will give you enough data for you to start charting your performance and run correlation among your data to find out what you are doing right and wrong. These are very simple points to track. However, they go along way when trying to identify your options trading edge.

Let us help you get started with this free option trading journal excel file.