What do you do when you’re trading, and losing money? When a whole series of trades goes wrong?

Do you get mad? Pound the table? And then jump right back in with another trade?

Or do you get nervous? Freeze up? Stop trading, and just wait until you feel better to start again?

Anger or anxiety are the two typical reactions traders give when they are on a losing streak. And it happens to all of us, because no one can win at trading all the time.

The trouble is, neither anger, leading to hasty trades, nor anxiety, leading to freezing up and missing opportunities, is a constructive reaction.

But can you learn to stay cool when trading goes wrong?

Trade your mind, not your gut

Experts tell us that emotion is the root of most poor choices in trading. You have spent time working out a strategy, trying it out, finding winning combinations, and then, all of sudden, nothing seems to make sense anymore.

Getting angry about it and then jumping into a trade intended to recoup your losses makes you feel better for a few moments, but it neglects the first rule of stock trading:

If you give the market a chance, it will certainly screw you.

So that blind, angry stab at a trade is almost certain to fail. And then you’ll be even more angry.

The Solution

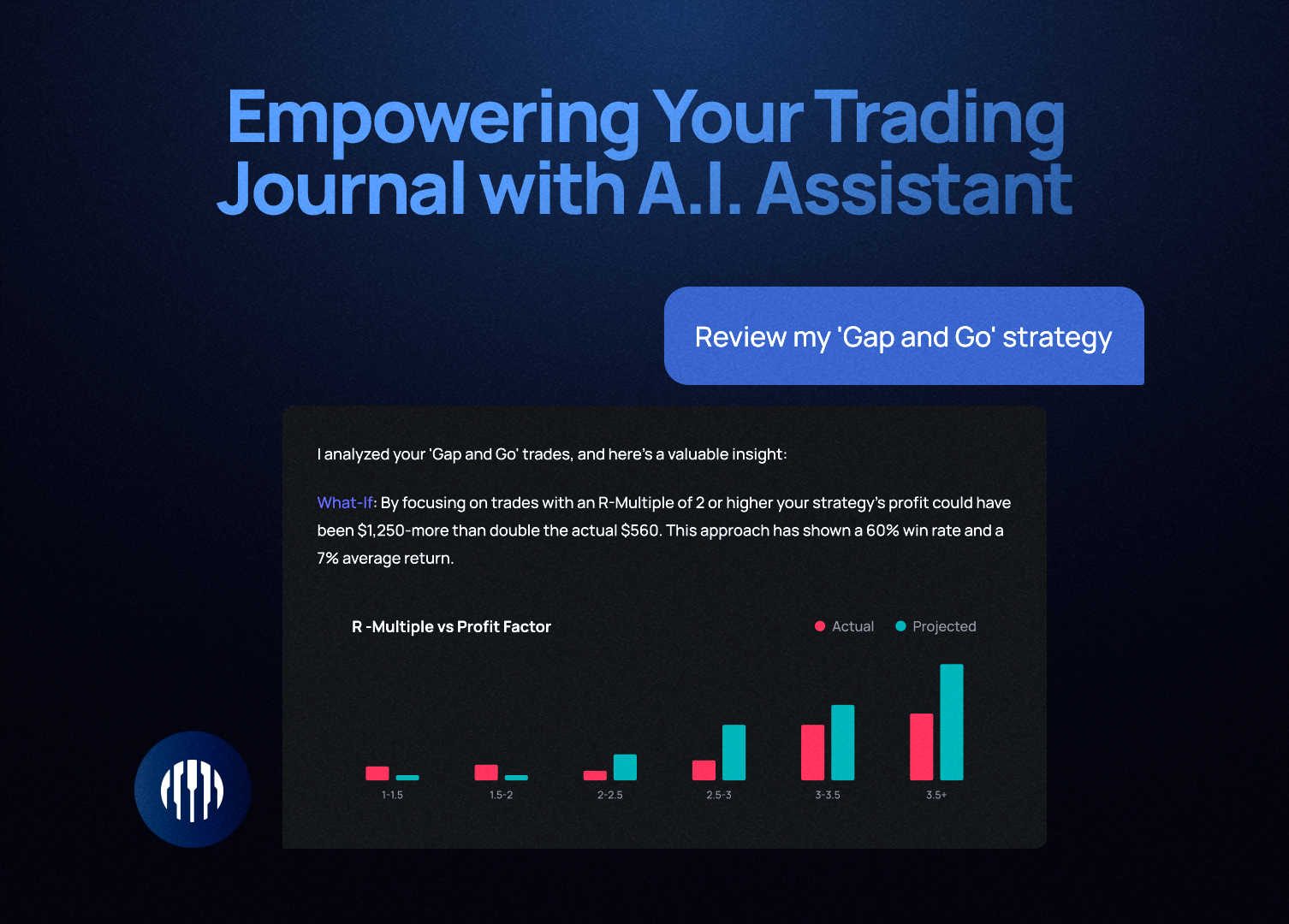

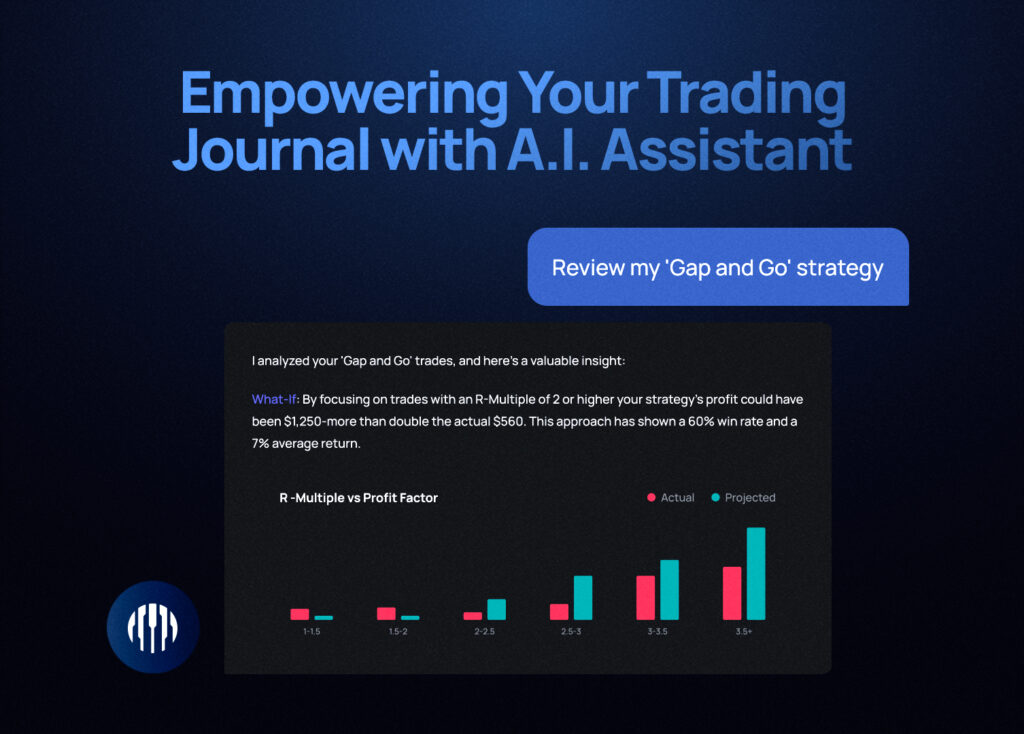

Instead, when you feel that anger rising, that’s the time to call up your trading journal and have a cool-headed rethink of what you’re doing. Has your strategy gone wrong with similar trades in the past? Your high-quality trading journal software allows you to zero in on the trades that went wrong before, and, if you’ve taken careful notes on each trade, allows you to cool off and recalculate the strategy.

The trading journal is your friend when anger threatens to take over. Keep a good journal, and it will help you to cool off and stay on track.

Don’t let anxiety build

But anxiety is just as much a foe to your trading strategy as anger is.

We all become anxious when we feel there is something threatening us that we cannot deal with. When the trades start going wrong, it’s only natural to start to worry, to let those nervous feelings build and to let them take over.

So you see an opportunity for a profitable trade, but then you think – do I dare? I’m not doing well, so maybe I should hold off.

Those irrational feelings of anxiety build up to a point where you are no longer capable of action. And so, one good opportunity goes by after another.

The Solution

Here again the trading journal software can help you get back on track. You look back at the trades you’ve made in the past when you’ve felt anxious – because your high-quality trade journaling software allows you to search for them.

And you calm down. Your anxiety is relieved, as you get back in touch with your trading logic. You start analyzing what’s been going wrong, and you find a new approach.

The trading journal is also your friend when anxiety takes over. Or, in any situation where your emotions are interfering with your trading.

Valentine's Day Sale — Up To 50% Off

Valentine's Day Sale — Up To 50% Off