We all want to make money out of the market and we want to make it not in a year, not in a month but today. Because of our rush and lack of understanding the odds we find ourself investing in the market without a real plan behind our ideas. We know we need a plan but we tend to think we can make money first and make the plan after. Our trading ego and lack of motivation to dissect our trading weaknesses can make it tough with keeping a trading journal. Well, it is not secret, this technique does not work for most of us.

Without a trading plan, we just fall into the 96% of the traders that lose money in the market. Let’s be real, we can not control the outcome of the market, the only thing we can control is how much we are willing to lose in a trade. This is why our plan should be focus on what we can control.

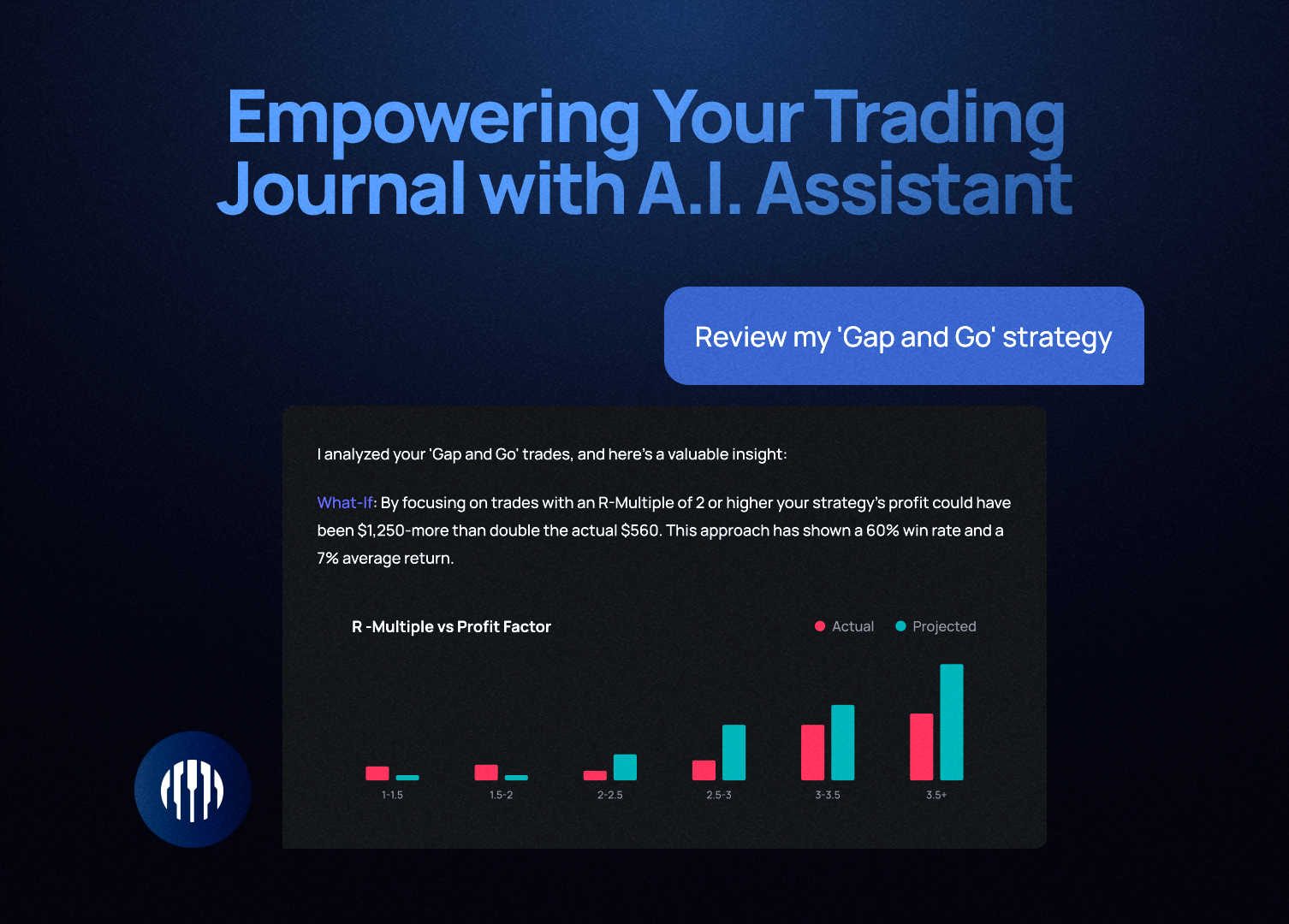

The potential solution to get into the small 4% that actually make money is to have a better understanding of our trading edge. This can only be gained from a trade journal. The tool that will run through your past performance and give you insight into what is it that you are doing wrong.

Yes, we all know we should be keeping a trade journal, every course you take online, every book related to trading the market will tell you that. The problem is how you come up with the willpower to actually developed a consistent habit of journaling your trades.

Keeping A Trading Journal

Start Simple: A trade journal can get very complex in terms of the different data points you could be collecting to get you more insight. We recommend you start by tracking only the essentials such but not limited to entry date-time, entry price, exit date-time, exit-price, position size and the reasoning why you took the trade. Just by starting with this six simple data points could give you enough insight for you to start gaining benefits out of your work.

Make a Rule: Do not just try to journal at different points of the day, instead start by journaling right after you took the trade. Immediately you should write down, why you took the trade and the details. Making yourself to write down this information after each execution will help you create a consistent habit.

Understand it is a long-term investment: To gather helpful feedback from your trading journal you must log in at least 100 trades if you are a day trader. You can not expect to gain benefits right out of the start. The benefits come with the long-term investment into placing your data in one place so you or a system can then help you determine your trading edge.

Want to begin keeping a trading journal? Then click here to signup for a free 7-day trial of TraderSync!

Valentine's Day Sale — Up To 50% Off

Valentine's Day Sale — Up To 50% Off