If you trade stocks on a number of international exchanges, then trade journaling can be of enormous help to improving your performance.

Trading in London, Frankfurt, Sydney or even Shanghai is easy and cheap today, as the Internet has made access to local trading platforms a snap. Setting up an account abroad is no longer a challenge, and the chance to find market conditions that fit your strategy is much increased.

But keeping track of your performance across a number of different exchanges can be a significant challenge. You do have to take into account currency fluctuations, which are a major issue in this time of increased volatility. You will want to keep careful track of the currencies you trade in, particularly since you may wish to switch funds from one exchange to another when the value of local money changes.

Obviously, the economic environment will be very different in the international markets you choose to work in. Australia may be slowing down at the same time that Sweden is picking up, and that of course means a different approach to trading on the different exchanges.

You will also need to tweak your strategy for each market. Investors don’t react the same way in London as they do in New York. In some markets – Shanghai provides an extreme example – the rules governing equities investing are quite different from those of other markets.

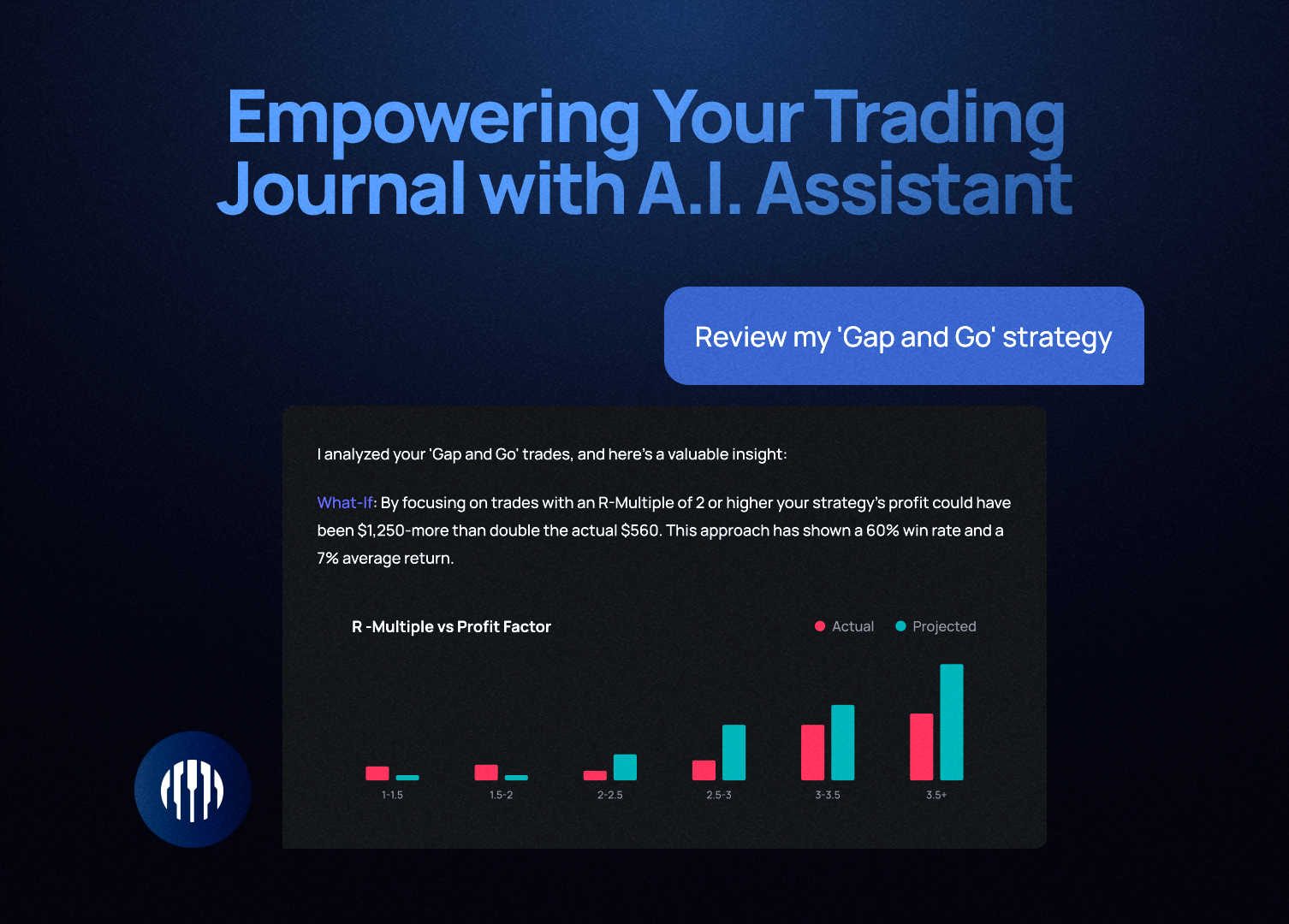

And there’s more, so, with all these factors to consider, trade journaling becomes imperative to control strategy and boost performance. With each trade you make in London or Frankfurt, you will want to make careful notes on sentiment, environment, trading volume, and even factors like how markets behave at specific times.

You will have a trading strategy honed on Nasdaq or NYSE; you will have to carefully evolve it so that it fits Milan or Madrid. This will mean careful journaling to show where the strategy is successful, and where it might profit from some improvement.

The great thing is that, by journaling your trades on the different exchanges, a great number of strategic patterns will emerge. While trading is different from one international exchange to another, there are important similarities that will produce patterns that work on both exchanges, perhaps on all of them. You will be gaining a wealth of experience by trading across the globe, and you will be able to put it work wherever you are trading. Journaling will provide the analytical basis for successful strategies, and you will see your trading improve sharply as a result.

Saint Patrick Day — Up To 50% Off

Saint Patrick Day — Up To 50% Off