Backtesting is the process of testing a trading strategy against historical market data to simulate its potential performance. It helps you gain insights into a strategy’s strengths and weaknesses before risking real capital.

How can I get started?

-

- Click on the “Strategy” icon on the left menu.

- Click on “Backtest“.

Creating a Backtest

- Click “Create Backtest.“

- General Settings

- Name: Give your backtest a descriptive title.

- Description: Add a brief explanation of your strategy.

- Data to Test

- Date: Select your desired start and end dates.

- Bars Deep: How much historical data to backtest.

- Precision: Candle size (e.g., 1 minute, 1 hour).

- Side: Long or Short trades.

- Trade By: Price point on a candle for evaluation (e.g., close price).

- Extended Hours: If backtesting stocks, choose whether to include pre/post-market data.

- Tickers: Select the asset(s) for your test. Start with one, then add more once you’ve verified that the backtest functions properly.

- Account Details

- Initial Capital: Realistic starting balance.

- Cash Sharing (Multi-Ticker Tests Only): Decide if you want to split capital.

- Commissions: Set default amount.

- Entry Conditions

- Click “+” to add an entry rule.

- Select from 70+ indicators, 100+ candlestick patterns, or basic price conditions.

- Example: “RSI (14) crosses above 70.”

- Exit Conditions

- Follow the same “+” process.

- IMPORTANT: Stop losses and targets take priority over indicator/candle conditions.

- Aim to include at least a stop loss and a target.

Considerations:

- Click on indicator names to fine-tune their parameters.

- To run a backtest, you must fill up all the required fields detailed above in this article. Only once you fill up all this information, you will see the “Run Backtest” button.

Running a Backtest

- Once your strategy is defined, click “Run Backtest“

- This may take a few seconds to minutes, depending on your settings.

Analyzing Backtest Results

The results page provides a summary of your backtest’s performance.

Key Metrics: Win Rate, Profit Factor, Expectancy, Drawdowns, and more.

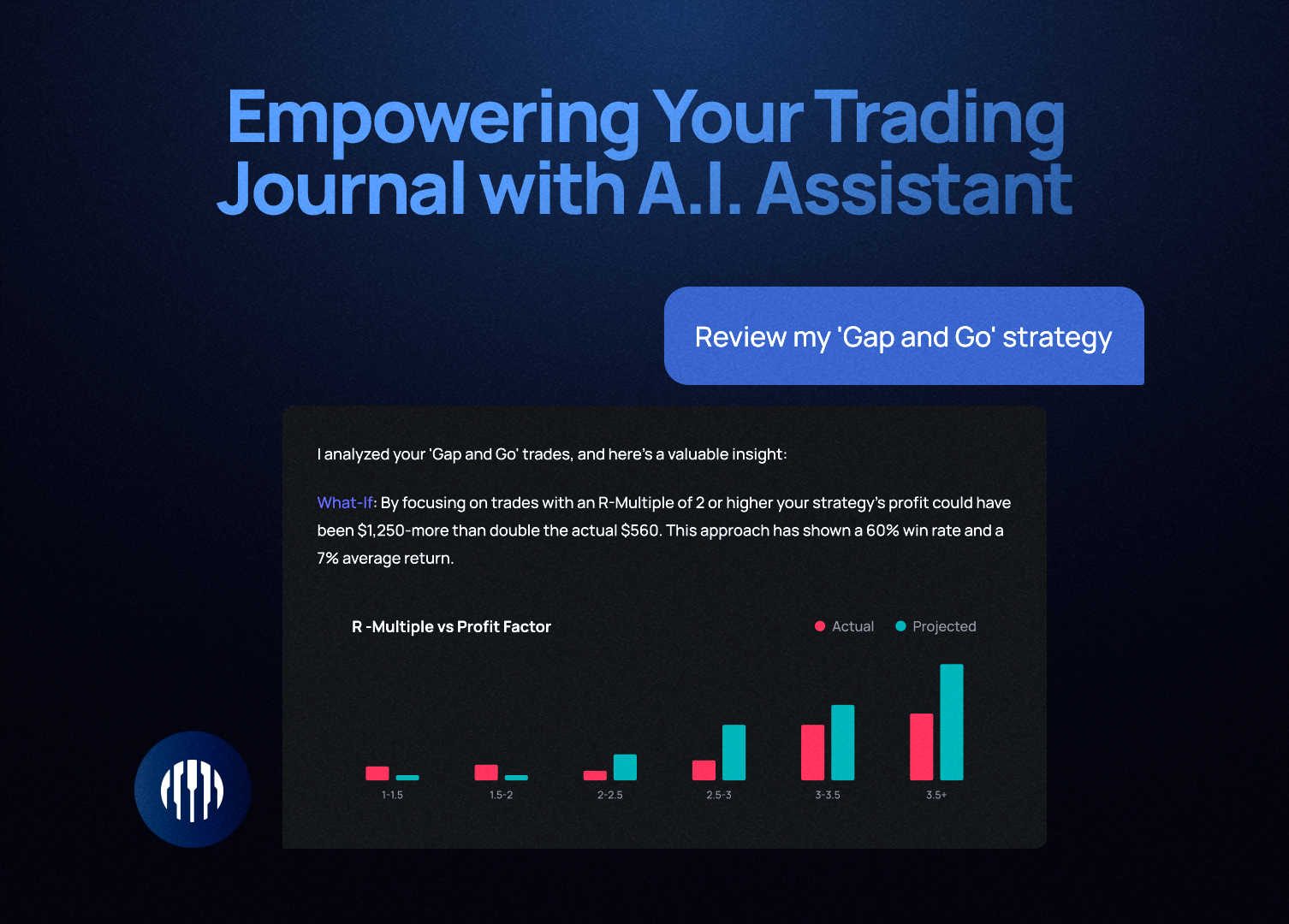

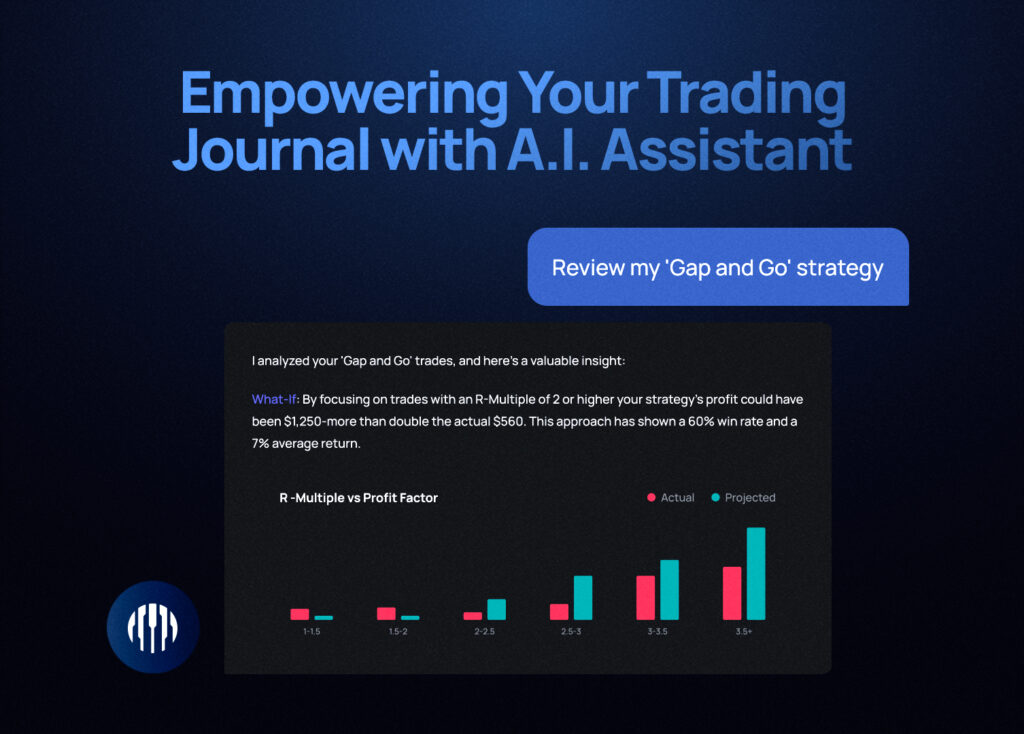

Deeper Analysis with TraderSync Analytics

- Click “Export Trades” to create a portfolio of your backtest results.

- Analyze further within TraderSync Analytics to pinpoint areas for improvement.

Remember

- Backtesting is an iterative process. Test, refine, and retest!

- Beware of overfitting your strategies to the past.