You will find a trades table on the “Classic Dashboard” as well as on the “Trades” section. Both trades table columns can be easily customized to contain stats that are more relevant to you.

For example, if you are an options trader you might want to see as columns the “Expiration(s)”, “Strike(s)”, and “Spread(s)” as columns. To achieve this follow these steps:

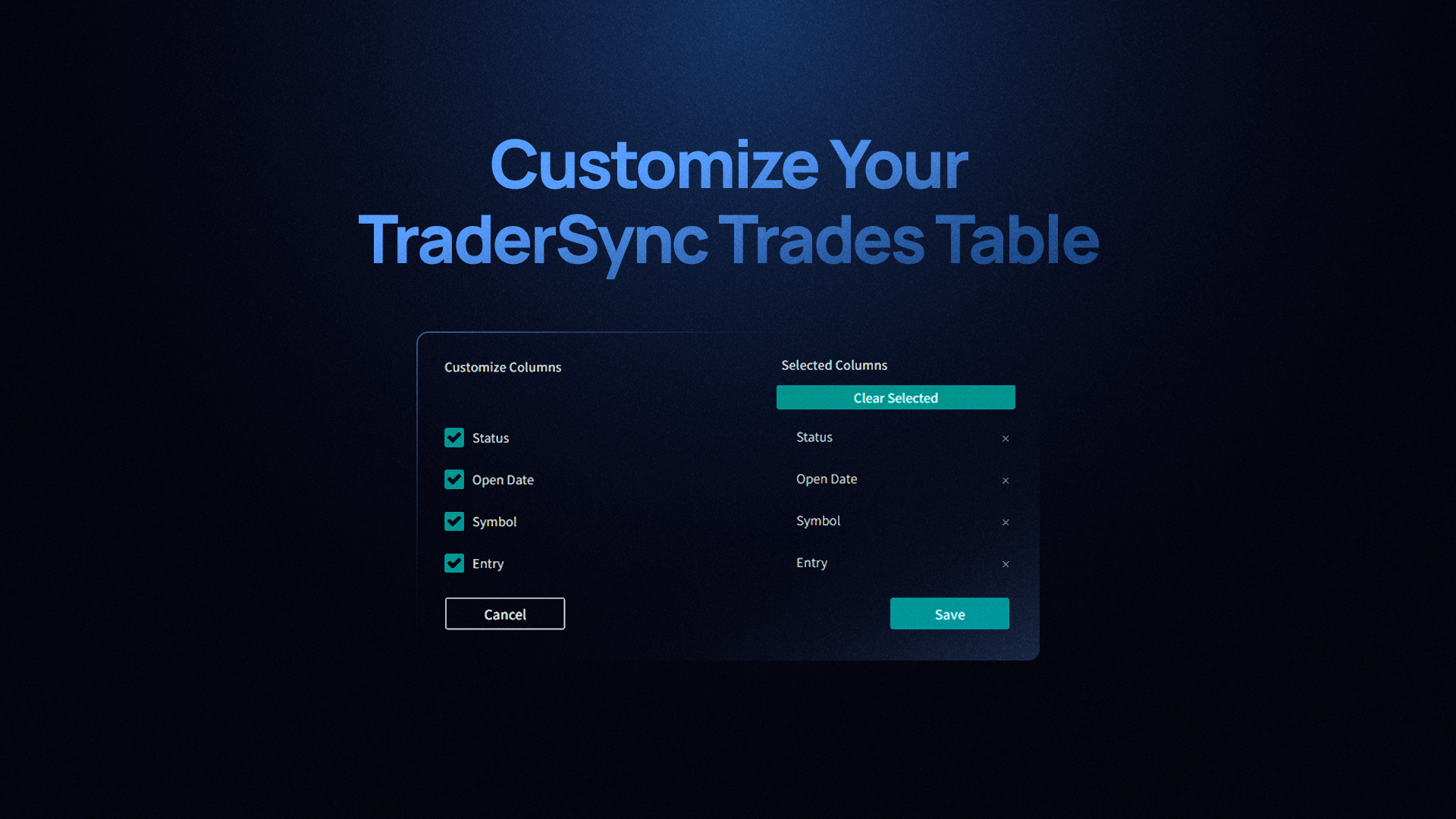

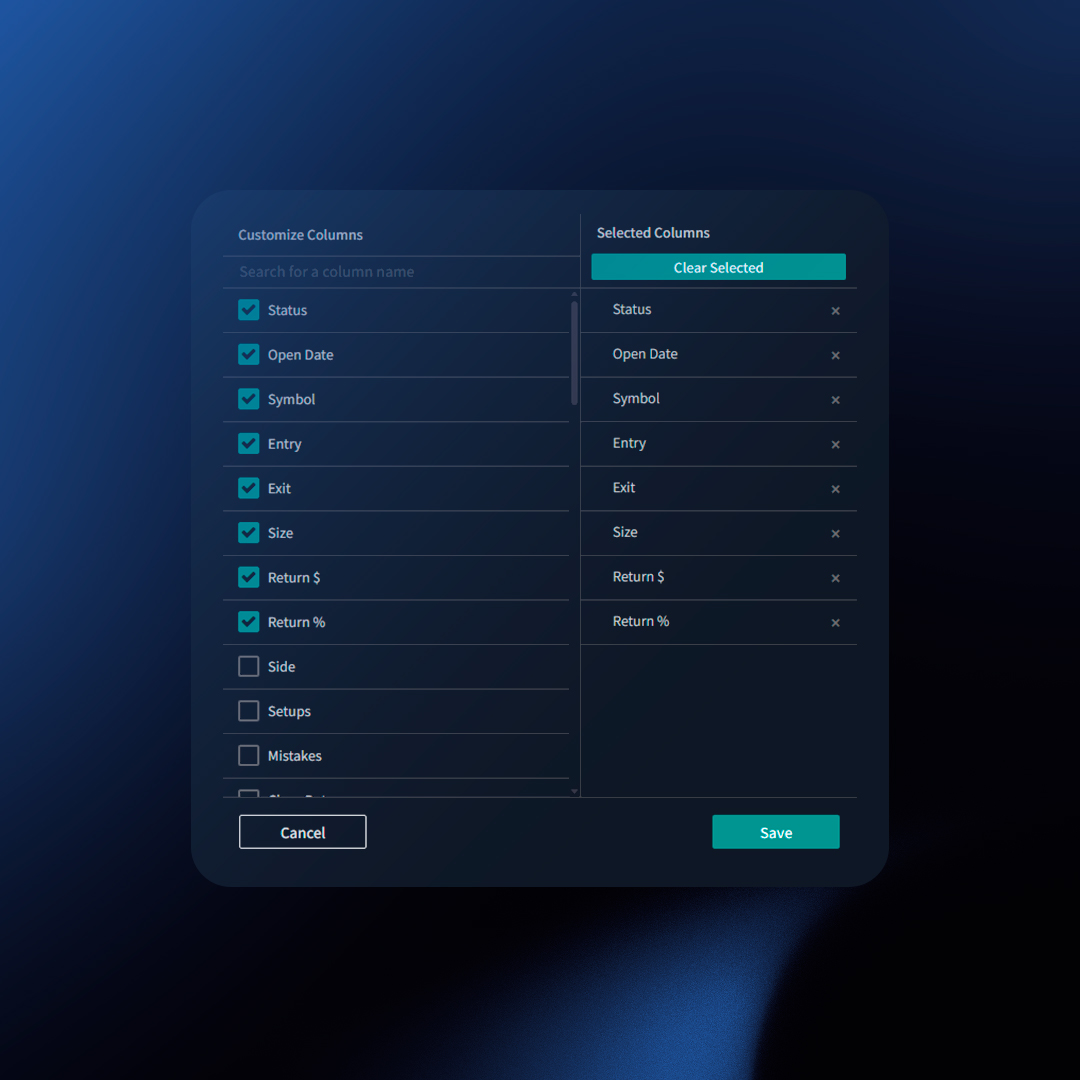

- On the trades table click on the gear icon.

- From the left panel select the stats or data points that you want to activate as columns.

- On the right column you will see a list of your current column selection, here you can rearrange them or remove any undesired columns.

- Click “Save”.

Considerations

- You can define a different set of columns on the Dashboard and on the Trades page.

- You can reorganize the order of the columns.

Available Columns Include

Core Trade Data

- Status: Outcome of the trade (Winner, Loser, Breakeven, Open).

- Open Date: Date the position was initiated.

- Close Date: Date the position was fully closed.

- Open Time/Close Time: Timestamps for the initial and final trade executions.

- Side: Long or Short.

- Symbol: The traded instrument.

- Portfolio: The account where the trade belongs.

- Size: Quantity traded.

Execution Details

- Entry Price: Price of the initial entry order.

- Exit Price: Price of the first closing execution.

- Avg Entry: Average price across all entry executions.

- Avg Exit: Average price across all closing executions.

- Executions: Count of individual executions within the trade.

Performance Metrics

- Return Gross: Gross profit/loss.

- Return Net: Profit/loss after commissions.

- Gross Return %: Percentage gain/loss.

- Net Return %: Percentage gain/loss after commissions.

- Gross R-Multiple: Trade’s return expressed as a multiple of the initial risk.

- Expectancy: (Needs a more trader-focused definition)

Risk & Reward

- Risk: Total amount risked on the trade.

- Stops: Initial stop-loss price.

- Targets: Initial target price.

- Profit Aim: Initial target return amount.

Error & Learning

- Mistakes: Tags for the specific errors made on the trade.

- Setups: The trading setups employed.