Filtering your trading performance analytics unlocks deeper insights and empowers you to make more informed decisions. By isolating specific strategies, timeframes, market conditions, or individual assets, you can pinpoint the root causes of both successes and failures. This granularity facilitates targeted strategy refinement, allowing you to identify areas where you excel and double down on those strengths while also pinpointing weaknesses in need of improvement. With these data-driven insights, you can continuously hone your trading approach, leading to more consistent and profitable outcomes.

How Filtering Works

On TraderSync reporting pages, you’ll find filters at the top of the website. These filters can be applied at any time to refine your data.

To apply a filter, simply click on the filter and select the criteria you want to filter by.

Applying a filter in TraderSync will affect all report pages, including the journal section, as filters are applied globally. This allows you to navigate different reports that have been drilled down by the filter you applied.

How to Remove a Filter

- To remove a specific filter: Hover over the filter you want to remove. A crossing line will appear on the filter. Click it to remove only the selected criteria.

- To remove a family of filters: Click on the “X” next to the applied filter.

- To remove all filters at once: Click the link called “Clear Filter” next to the filtering buttons.

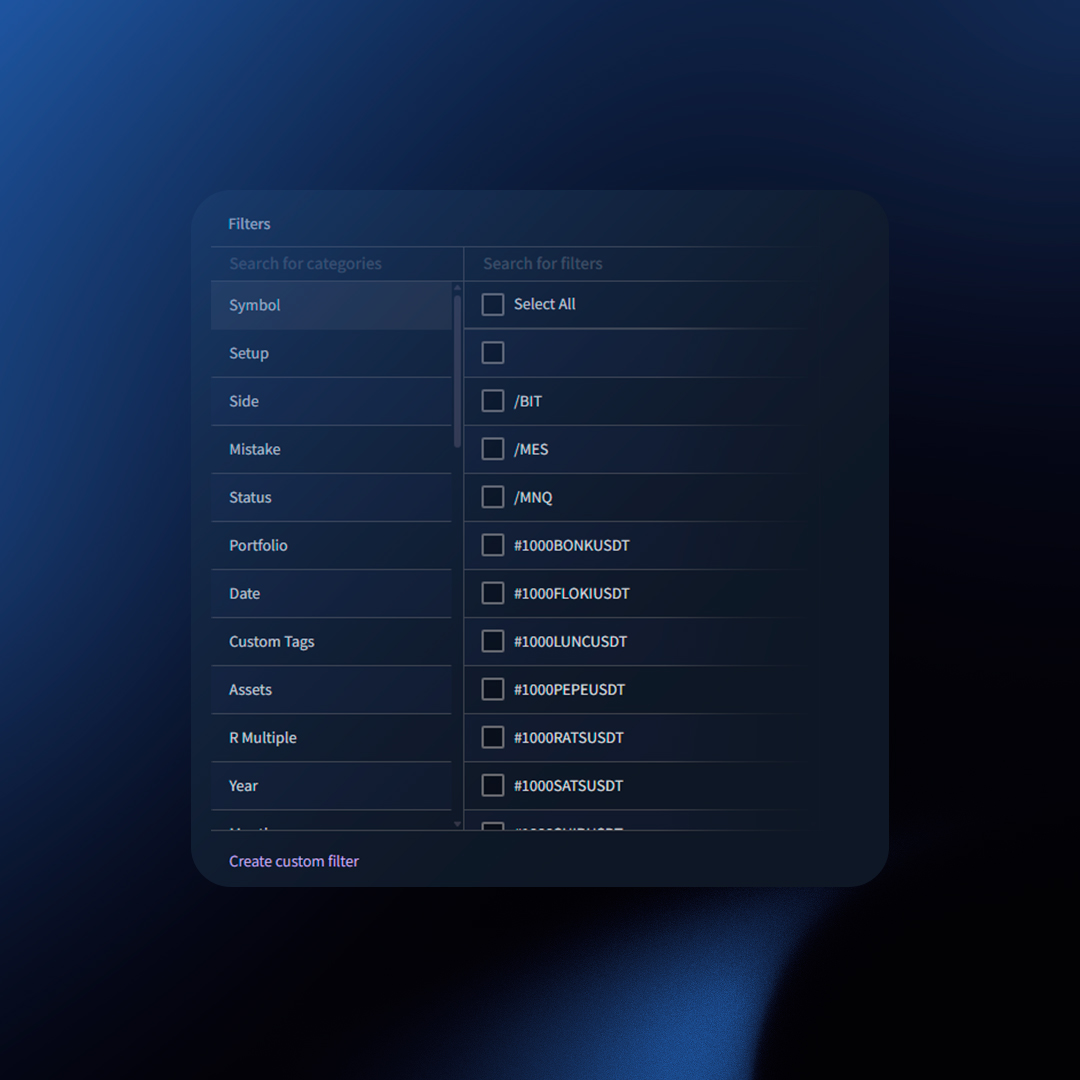

What Filters Are Currently Available?

- Symbol

- Setup

- Side

- Mistake

- Status

- Portfolio

- Date Range

- Custom Tags

- Strike

- Expire

- Sector

- Year

- Assets

- Entry Price

- Day of Week

- Volume

- Month

- Hour of Day

- Broker

- Market Cap

- Volume Change

- Change Percent

- Hold Time

- Call/Put

- Spread

- Position MFE

- Position MAE

- R Multiple

- Best Exit PnL

- Best Exit %

- Market Movements (SPY / SPX)

- Opening Gap (SPY / SPX)

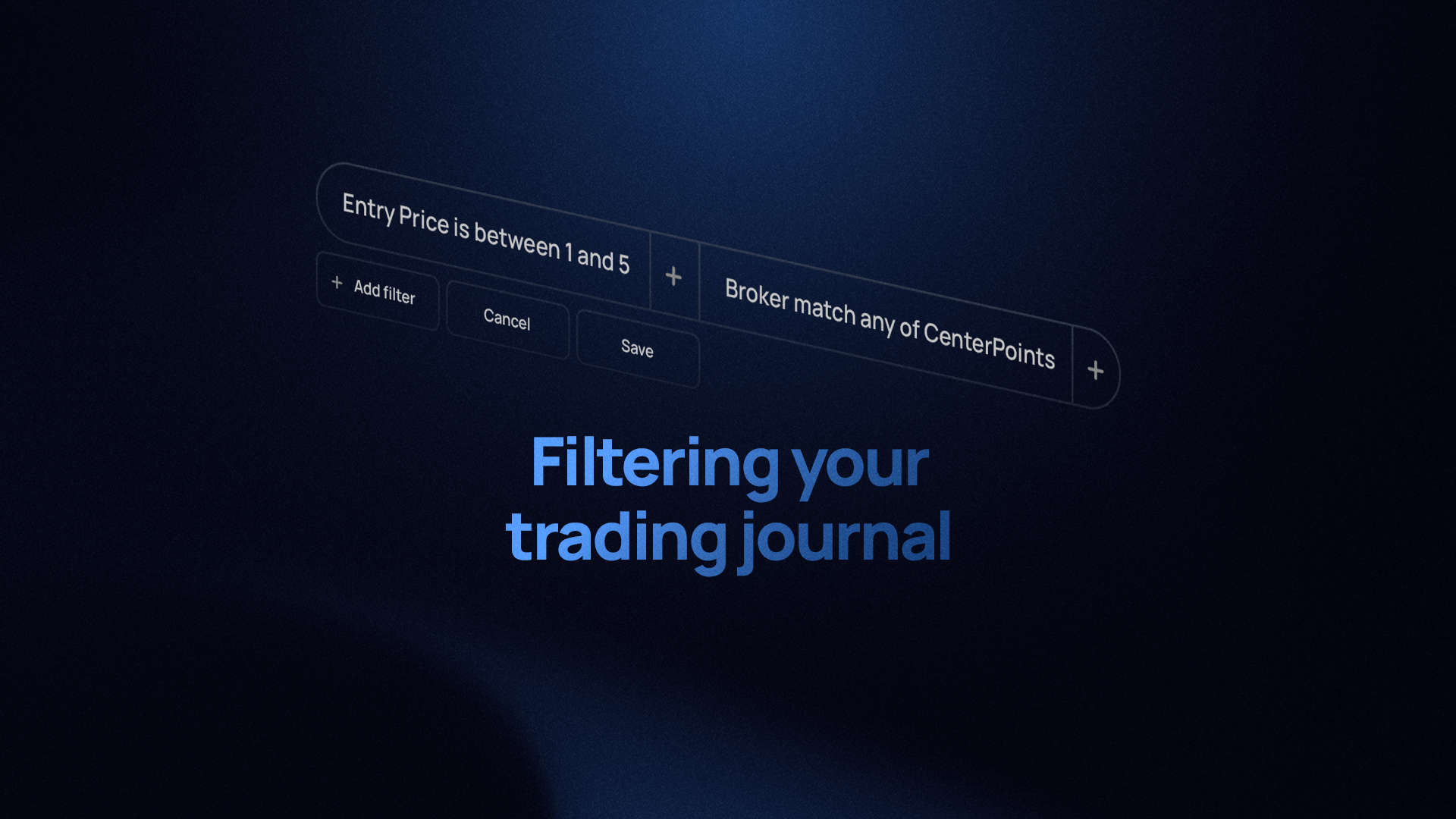

- Custom Filtering

Custom Filtering

To ensure maximum flexibility in drilling down reports, TraderSync offers custom filtering criteria. This allows you to quickly and easily build queries to filter your trading journal by.

Example: Filter by trades that:

- Have the setup “Gap and Go”

- Are not placed on “Tuesdays”

- Have a minimum PnL of $500 and above

- Do not have the mistake “FOMO” tagged

Examples of How Filtering Can Help You Identify Opportunities

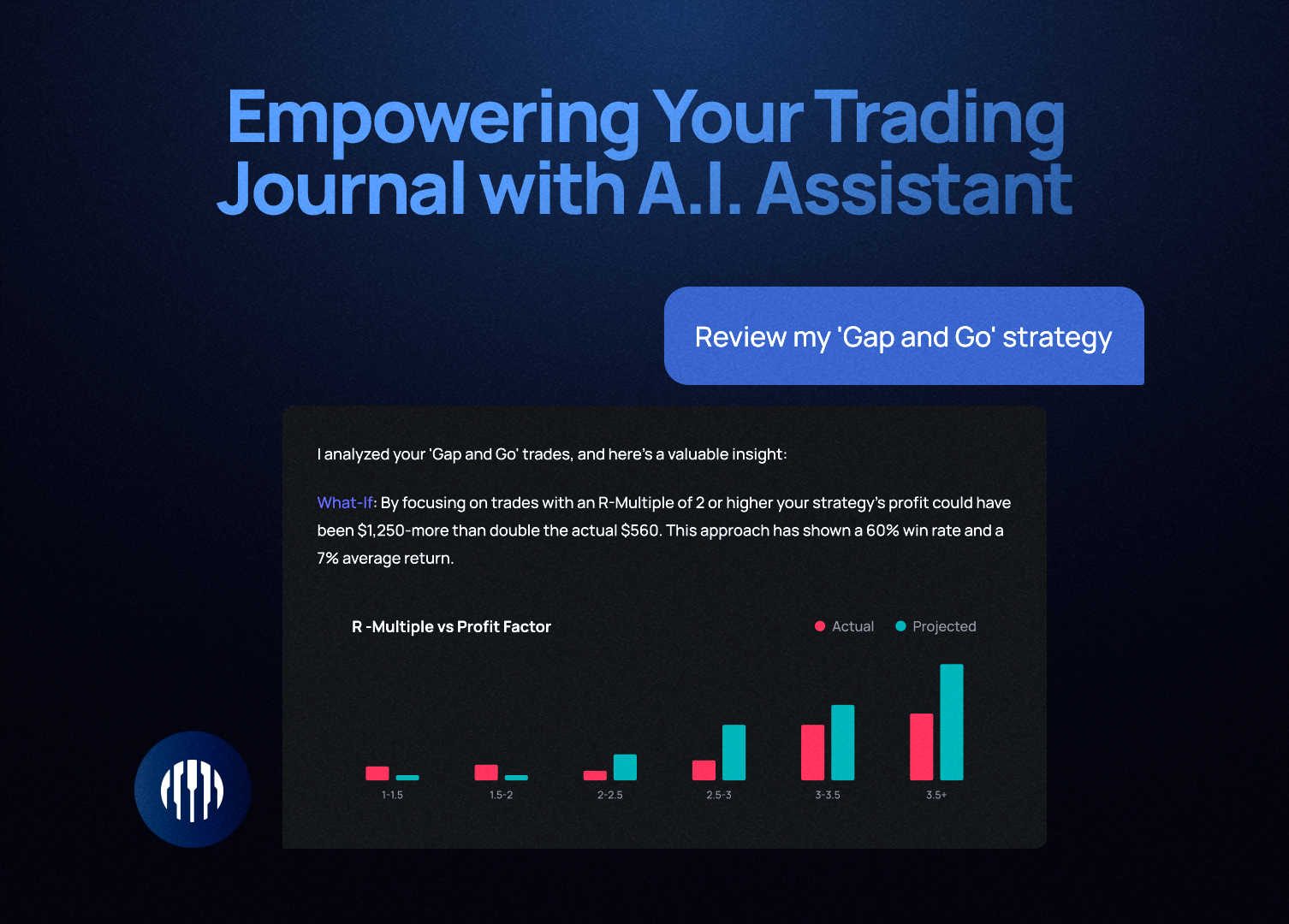

Refining Your Strategy

Imagine you’re working on your “Morning Breakout” strategy. By filtering trades by this specific setup, you can easily analyze performance data. Once the filter is applied, review the reports to see if any patterns arise that highlight what is working well and identify opportunities to reduce losses. This helps you pinpoint the most profitable times to trade and adjust your strategy to maximize gains.

Reducing Errors

If you’ve noticed frequent mistakes tagged as “FOMO,” you can filter by “FOMO.” Once the filter is applied, you can visit the multiple reports that we offer and see if there is a pattern in terms of when you are making this mistake. This allows you to analyze successful trades more closely and understand what actions lead to better results, helping you reduce errors in the future.

Tips and Tricks

- Apply a filter by symbol by clicking on any symbol from your trades table.

- Apply a filter by setup/mistake/custom tag by clicking on any tags from your trades table.

- On your reports tab, you can drill down any report by clicking on a specific point on the graph. This will automatically apply the corresponding filter for you to drill down on your reports. Remember to remove the filter once you are done with your analysis.

Valentine's Day Sale — Up To 50% Off

Valentine's Day Sale — Up To 50% Off